Possible Futures #002: Gridless

How to finance clean energy expansion with bitcoin mining

For communities who have never had electricity, a lightbulb means a lot of things.

A lightbulb means a safer night[1]–one where streetlamps make it easier to get around, crime rates are lower, and shops and businesses can stay open later.[2] A lightbulb at home means a day that doesn’t need to end when the sun goes down.

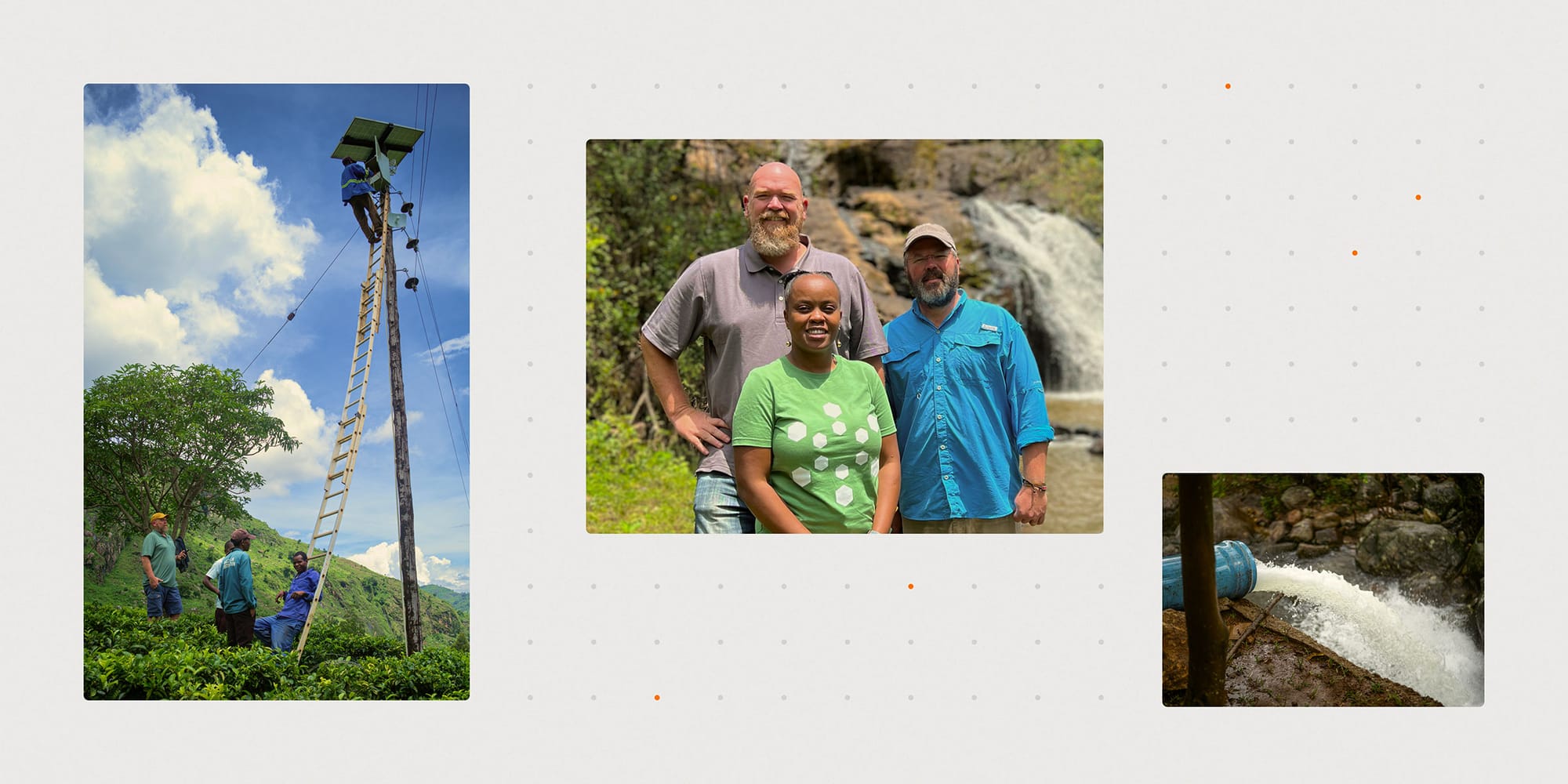

“It is simple things like, ‘my child is able to do their assignments, on time and at home, because we have electricity,’” says COO and co-founder of Gridless Janet Maingi, an operations, logistics, and supply chain expert whose 20+ year career spans internet connectivity, satellite communications, hardware and software.

A lightbulb also means better health outcomes. It means no kerosene for light, eliminating indoor air pollution linked to poor health outcomes and millions of deaths annually.[3] It means a midwife at the local clinic can catch a newborn with both hands–and that newborn has easier access to childhood vaccines.

“It's not uncommon in a village without power for a midwife to deliver a baby by the torch on a cell phone,” says Philip Walton, Gridless Co-founder and CTO, a domain-spanning tech entrepreneur for the past 30 years.

“Now local health clinics can have lights, they can operate at night, they can have refrigerated storage for vaccines,” he says.

“We have women in Malawi, who are suddenly able to access vaccines closer to home,” says Janet. “Before, they used to opt for, I’ll either take this vaccine or not because it involves traveling so many miles just to get a jab for your child. Now they can walk.”

Not to mention third order effects–the productivity gained in switching from manual tools to power tools, the possibility for businesses to start and expand, the countless conveniences that most in the electrified world take for granted. A lightbulb seems like a tiny thing, but it represents something much, much larger.

And in a small but growing number of communities across Kenya, Malawi, and Zambia, the lights are turning on because of bitcoin mining.

Stuck in the dark, stranded in the bush

As of January 2025, some 600 million people on the African continent were without reliable access to electricity–that’s more than 80% of all the people on Earth whose days largely end at dusk.[4] It’s a stark statistic, particularly set against the fact that Africa has more than enough natural resources–hydro, solar, geothermal, wind–to be a place of clean energy abundance.

The way to marry those two things, though–the huge unserved population and a vast amount of latent energy–hasn’t been obvious.

Many models for electrical expansion tend to rely on subsidy or government funding–which can mean the power turns off when the funding dries up.

Others have started ambitious power projects as profit-seeking endeavors from a place of “if you build it, they will come,” but the reality is not that straightforward. Demand (in terms of paying customers) is low outside of large urban centers, and pushing the grid outward to the rural fringes is expensive.

“It's a willful delusion that they're going to deploy a multi-million dollar asset in a remote African village whose population is going to be able to repay them their investment,” says Philip. “It doesn’t work.”

The idea for Gridless, a company that may have cracked the code for bitcoin-financed clean energy expansion, came from precisely one of these ventures.

A few years back, before Gridless existed, Philip and now co-founder Erik Hersman went on an expedition to Northern Kenya.

“We love to find a point on a map and just be like, ‘we're going to go there,’” says Philip. “You know, motorcycles and land rovers, we're going to bash our way out to this point and have an experience.”

At the time, the government of Kenya had partnered with some European governments to build a 300+ megawatt wind farm on the shores of Lake Turkana. But they hadn't built the transmission lines–a separate project that itself would take another four years to complete. With turbines up but no lines to move the power, 300+ megawatts (enough to power as many as a million homes in Kenya) was literally stranded, effectively useless.

“When we learned that energy was on what was called a ‘take or pay’ contract, meaning the government had to pay for the power even if there were no transmission lines to get it back to the grid, we started thinking about, ‘what is a geographically agnostic large consumer of electricity that doesn't require logistics?’” said Philip.

Bitcoin mining, it turns out, was the answer.

“The idea that Bitcoin mining can effectively go anywhere, connect to any power source and monetize anything that can't be sold to the local community or to the grid I think has proven to be one of the best use cases of Bitcoin mining on the planet,” says Philip.

While Gridless didn’t immediately spring to life from that opportunity, the idea for it did. A few years later, Erik and Philip dusted off that idea, joined forces with Janet, and Gridless was born.

From “take or pay” to “first and last resort”

“We started out only attaching to existing power sources,” says Philip. “When we started Gridless, it was: find stranded energy, plug in Bitcoin mining, and monetize the stranded energy.”

And that worked–and continues to work–very well. Just this year, Gridless made a deal with a hydropower company in Northwestern Zambia–a site that was built 15 years ago, but had never managed to sell more than 30% of their energy to their local community: they’d act as buyer of last resort, meaning they’d buy every kilowatt hour produced that the local community (the buyers of first resort) wouldn’t.

“And so we did, and it instantly transformed that business. I mean it solved their cash flow problems literally overnight,” says Philip. “Because the great thing about Bitcoin mining is you get paid every day. If you mine all day, you wake up the next morning and there's Bitcoin in your wallet. That was super transformative.”

“And with Gridless coming in and taking up that stranded power,” says Janet, “they’ve actually been able to reduce the cost of power, and reach out to more people who can now sign up because the power is more affordable than it was before.”

And while solving stranded energy problems is great, and lowering energy costs is great, too, there’s a larger problem at hand.

“What we realized,” says Philip, “is that not only is Bitcoin a tool for solving wasted energy, it's actually a tool for financing new energy development.”

On top of turning stranded energy into Bitcoin, Gridless is now working to build brand new energy projects where Bitcoin mining will be the buyer of first and last resort.

“From day one, we’ll sell 100% of what we produce to Bitcoin,” says Philip. “And then, as the community demand grows, we’ll sell to the community as a priority over Bitcoin.”

They do this kind of balancing between community usage and bitcoin mining via real-time demand response based on the energy network itself. By monitoring factors like generation output, how much energy is being exported to the grid, what the overall capacity is, and what the frequency is on the energy network, Gridless can determine how much energy is available for mining in real time.

“So if somebody in a village turns on a maize mill, then we’ll turn down a machine. And if suddenly somebody turns off their irrigation pump and now there’s an excess, we’ll ramp machines back up,” says Philip. “We really do fill in that gap of taking every unit that can be produced but isn’t required by somebody else.”

Acting as buyer of first and last resort means there will never be a case of selling only 30% of energy produced–nor will there be four years worth of possible energy production stranded in the bush.

“There will never be a day that we don’t sell everything that we produce. And that one change takes a project from in most cases a ‘never ROI’ to a three- to five-year ROI on that same infrastructure project,” says Philip. “It means you now have a 50 year revenue generating asset that’s fully paid for in the first five years and can continue to deliver electricity for the next few decades.”

And it’s all clean power. The idea that bitcoin mining could actually be the engine driving clean energy expansion flips popular narratives around bitcoin and energy use on their head.

The future of bitcoin-financed electricity expansion in Africa

Talking with the Gridless co-founders, it feels like they’re on the cusp of something big–like they’ve quietly figured out how to solve what has been a truly intractable problem and are now working on making the solution bigger, reaching more people with it, and decentralizing bitcoin in the process.

“Of course, we’re mining and we’re profitable,” says Janet.

But success is measured in more than sats. As a business, Gridless is really aiming to make a world-changing impact.

“I think, in five to ten years, we can roll out enough new energy to make a dent in the 600 million Africans who don’t have access to affordable electricity,” she says. “I don’t know what that dent would be, I just want that number to drop because it’s been constant for years.”

Looking farther out, the model seems truly transformational. On a 20- or 30-year time horizon, the Gridless team sees an Africa that has gone from slightly better electricity access to an Africa with energy abundance–to going from being the one place on earth where half the population lacks access to electricity, to the one place on Earth where the entire population has access to cheap, clean, abundant electricity. And, in the process, Bitcoin becomes truly decentralized.

“100 years from now,” says Philip, “the impact is that the economies of these communities have grown and prospered and wealth is created and that Africa ultimately gets to achieve its potential in the world.”

“We’ve been so hampered by the fact that our continent hasn’t had enough electricity because there hasn’t been a model that you could build it without subsidy,” he says. “Bitcoin provides us that model.”

“Whether it's us doing it or others replicating what we're doing, the end result should be abundant energy and a full decentralization of the Bitcoin network.”

At Proto, our product development is informed by the real-world experiences of miners like Gridless, whose operational realities can be challenging. In remote, hard-to-service areas, sometimes many hours of rough roads away from an urban center, reliability is crucial. And in a “no stranded energy” kind of setup, advanced power management is equally important. These are just a few of the principles we’ve applied to our own mining product development. To learn more about Proto, visit proto.xyz.

References:

[1] Gyimah, Justice, Yang Liu, George Nyantakyi, and Xilong Yao. "The effect of mini‐grid rural electrification on urbanization: Evidence from the pilot mini‐grid systems in Ghana." Review of Development Economics 28, no. 3 (2024): 1108-1130. Available here.

[2] Akinbamiwa, Bamidele Paul, Raymond Edward Ereh, Shereef Pelumi Gbadamosi, and Akinbobola Sunday Oluwagbemileke. "The Impact of Solar Energy Expansion on Rural Electrification in Africa." International Journal of Engineering and Modern Technology 11, no. 3 (2025). Available here.

[3] Mutahi, Anne Wambui, Laura Borgese, Claudio Marchesi, Michael J. Gatari, and Laura E. Depero. "Indoor and outdoor air quality for sustainable life: a case study of rural and urban settlements in poor neighbourhoods in Kenya." Sustainability 13, no. 4 (2021): 2417. Available here.

[El Hillo, Yacoub. “Decoding Africa’s Energy Journey: Three Key Numbers.” United Nations Sustainable Development Group. January 27, 2025. Available here.

Authors

Stay in the loop

Subscribe to receive new post alerts and provide direct feedback to our team.